RESIDENTIAL MARKET

The number of residential sales in Windsor and Essex County remains fairly flat year to date as of July 31, 2013, with an increase of only 1%, compared to YTD July 31, 2013. The average price increased 4% to $181,210 from $174,144 during the same period. Active Listings as of July 31, 2013 was 2,738 compared to 2808 in 2012, this is a decrease of 2.6%. The market remains fairly balanced with a listing sales ratio of 54% year to date 2013 compared to 53% in 2012.

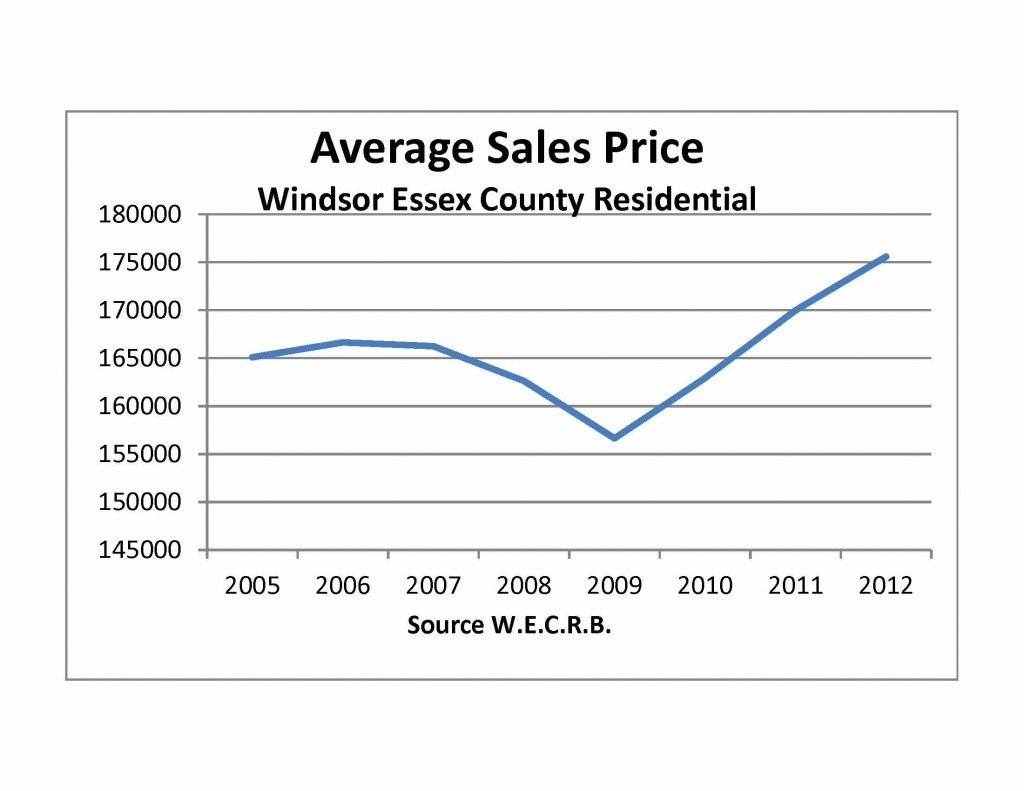

We are anticipating prices to continue to rise this year, as inventory levels remain low and demand remains steady. Many Windsor home owners have struggled with low home values. As property values continue to improve each year, we anticipate more home owners in future years will be looking to buy and sell, as they will have more equity available to them.

CONDO MARKET

The number of condo sales in Windsor and Essex County has increased 4.3% year to date as of July 31, 2013. The average price year to date increased substantially to $137,498 as of July 31, 2013 from $128,794 in 2012, representing an increase of 6.8%.

Active Condo Listings as of July 31, 2013 was 225 compared to 259 in 2012, this is a decrease of 13.1%. . The Listing Sales Ratio increased to 54% year to date as of July 31, 2013 compared to 50% in 2012.

The substantial drop in condo inventory is putting upward pressure on condo prices. With rising prices and steady demand, we expect the construction on new condominiums will begin to resume within the next 1 - 2 years after coming to a halt in 2009.

Other News: The City of Detroits declaration of Bankruptcy. Detroit tax base has fallen dramatically, as the city struggles with a declining population, declining property values, and hi vacancy. However Michigan as whole is now in recovery with prices recovering rapidly from their substantial drop in 2009.

Windsor is still struggling with unemployment, Windsor's jobless rate moved up to third in Canada in June despite the fact it fell marginally from 9.5 per cent in May to 9.4 per cent last month.